9 Simple Techniques For Eb5 Investment Immigration

Table of ContentsEb5 Investment Immigration - The FactsGetting The Eb5 Investment Immigration To WorkAll about Eb5 Investment ImmigrationEb5 Investment Immigration Things To Know Before You BuyTop Guidelines Of Eb5 Investment Immigration

While we aim to offer accurate and current content, it must not be considered lawful guidance. Immigration laws and laws are subject to transform, and specific situations can differ widely. For customized guidance and lawful suggestions regarding your particular migration scenario, we strongly advise seeking advice from with a certified immigration lawyer that can give you with tailored assistance and make certain compliance with existing laws and guidelines.

Citizenship, with investment. Currently, since March 15, 2022, the amount of financial investment is $800,000 (in Targeted Work Locations and Rural Locations) and $1,050,000 elsewhere (non-TEA areas). Congress has actually approved these amounts for the following five years starting March 15, 2022.

To qualify for the EB-5 Visa, Financiers should produce 10 full time united state tasks within two years from the day of their full financial investment. EB5 Investment Immigration. This EB-5 Visa Demand ensures that financial investments add straight to the U.S. work market. This applies whether the tasks are created straight by the business or indirectly under sponsorship of an assigned EB-5 Regional Center like EB5 United

Little Known Questions About Eb5 Investment Immigration.

These jobs are figured out via designs that utilize inputs such as development prices (e.g., building and construction and devices costs) or yearly profits produced by ongoing procedures. On the other hand, under the standalone, or direct, EB-5 Program, only straight, full-time W-2 employee settings within the company may be counted. A key risk of relying solely on straight workers is that team reductions due to market conditions can lead to insufficient permanent positions, potentially causing USCIS rejection of the capitalist's request if the work creation demand is not satisfied.

The financial version then projects the variety of straight work the brand-new company is most likely to create based upon its expected incomes. Indirect work computed via financial designs describes work created in industries that provide the items or solutions to business straight associated with the task. These tasks are developed as an outcome of the boosted need for items, products, or solutions that sustain business's procedures.

Unknown Facts About Eb5 Investment Immigration

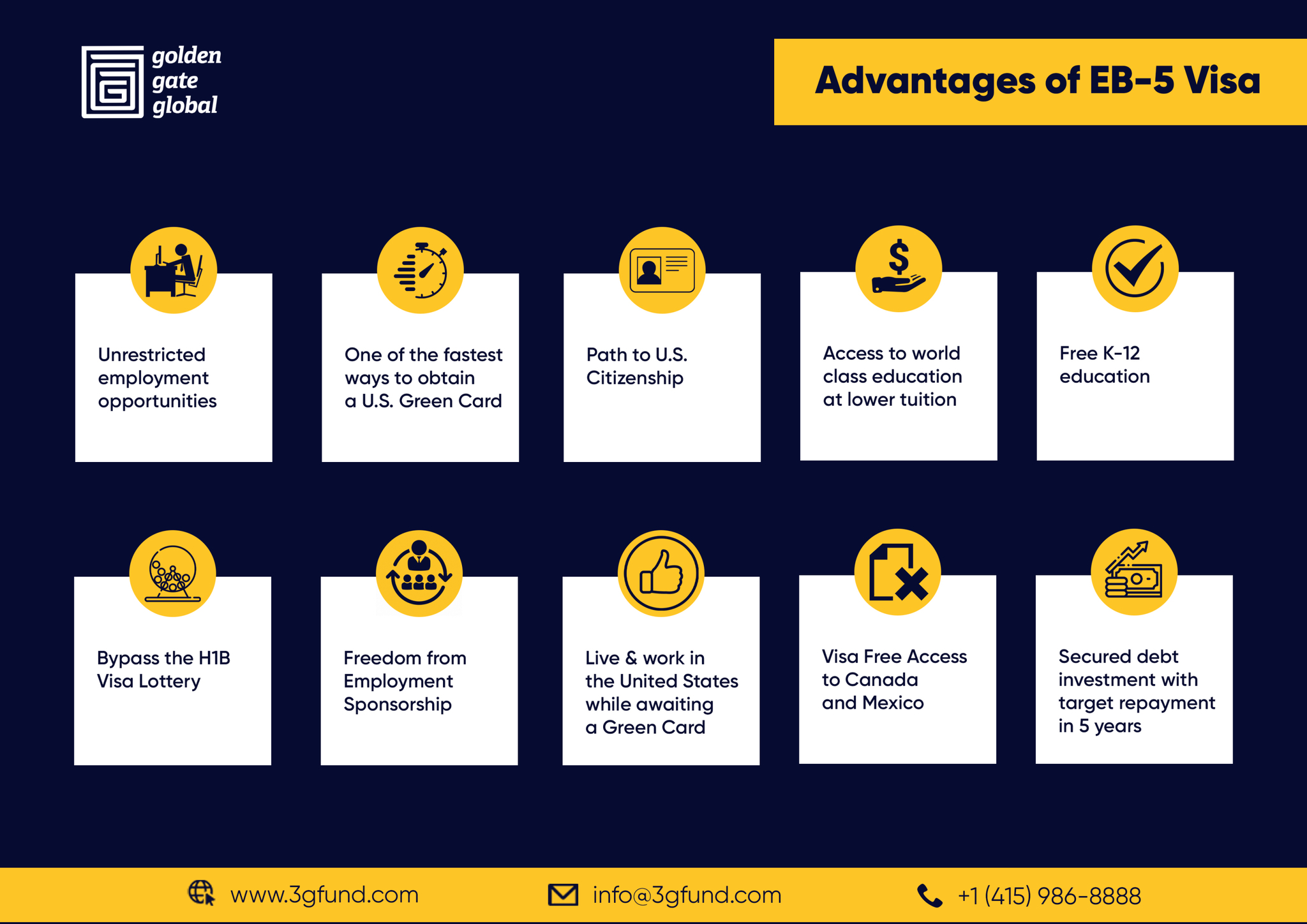

An employment-based fifth preference classification (EB-5) investment visa supplies a method of ending up being a long-term U.S. resident for foreign nationals hoping to spend capital in the USA. In order to request this eco-friendly card, an international financier has to spend $1.8 million (or $900,000 in a Regional Center within a "Targeted Employment Area") and create or maintain at least 10 full time jobs for United States employees (leaving out the capitalist and their immediate family).

This measure has been a significant success. Today, 95% of all EB-5 resources is elevated and spent by Regional Centers. Because the 2008 monetary situation, accessibility to capital has actually been constricted and local budget plans continue to face substantial shortfalls. In several areas, EB-5 financial investments have actually filled up the funding void, offering a new, crucial resource of resources for local economic advancement projects that rejuvenate areas, develop and sustain jobs, infrastructure, and services.

Little Known Questions About Eb5 Investment Immigration.

workers. Additionally, the Congressional Budget Plan Office (CBO) scored the program as profits neutral, with administrative costs paid for by applicant costs. EB5 Investment Immigration. Greater than 25 countries, consisting of Australia and the United Kingdom, use comparable programs to draw in international investments. The American program is a lot more stringent than many others, requiring substantial threat for investors in regards to both their monetary investment and migration condition.

Families and individuals who look for to transfer to the United States on an irreversible basis can make an application for the EB-5 Immigrant Investor Program. The United States Citizenship and Migration Provider (U.S.C.I.S.) set out various needs to obtain irreversible residency with the EB-5 visa program. The demands can be summed up as: The capitalist has to fulfill capital expense quantity demands; it is commonly required to make either a $800,000 or $1,050,000 capital expense amount into an U.S.

Speak to a Boston migration lawyer about your requirements. Below are the general actions to acquiring an EB-5 capitalist permit: The initial action is to find a certifying investment chance. This can be a new business, a local facility job, or an existing organization that will her latest blog be expanded or reorganized.

As soon as the possibility has been recognized, the capitalist needs to make the financial investment and send an I-526 request to the united state Citizenship and Migration Provider (USCIS). This request has to consist of evidence of the investment, such web link as financial institution declarations, purchase agreements, and organization plans. The USCIS will certainly review the I-526 application and either accept it or demand added evidence.

All About Eb5 Investment Immigration

The investor must look for conditional residency by sending an I-485 application. This request must be submitted within six months of the I-526 approval and have to consist of proof that the investment was made and that it has created at least 10 full-time jobs for U.S. employees. The USCIS will evaluate the I-485 request and either approve it or request added proof.